Maximizing Sales with Flexible Water Treatment Financing Options

- January 17, 2024

Published December 04, 2023

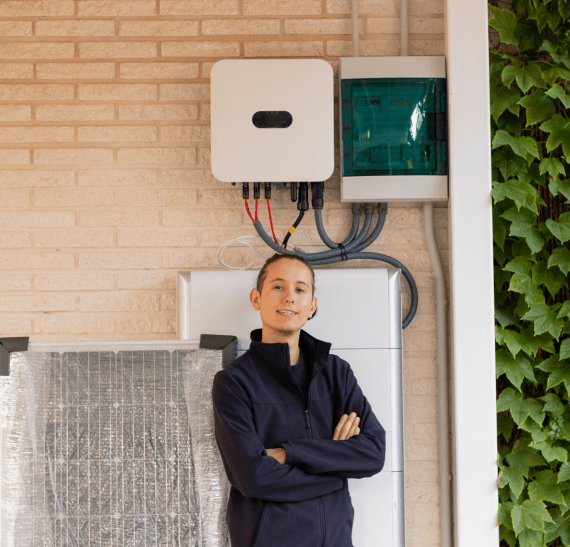

Charging Ahead: Transforming Financing for Power Solutions

Admin

Generators and backup batteries are essential solutions for homeowners caught in power outages due to inclement weather, equipment malfunction, and other unforeseen circumstances that can interrupt everyday life and even pose a risk to health and safety.

Generators and backup batteries financing programs through the Fund My Contract network of third-party lenders can be just as essential and effective solutions for small business owners caught in a downturn of growth due to missed sales projections, lost revenue, and other unforeseen circumstances that can significantly impact the success of the enterprise.

In both instances, these solutions can play an integral part in the growth of your business. More customers who need backup power equipment will turn to you for purchasing those high ticket items, particularly if they know you offer financing programs that can make buying and paying for those items easier and more affordable over a series of low monthly payments instead of all in one lump sum.

Fund My Contract is here to help your small business weather the storm of stifled growth due to stagnant sales and a lack of revenue. Financing options put high ticket items within reach for your customers and the choice of programs that offer multiple ways of paying for these products will increase sales and foster loyalty to your business with positive reviews and recommendations to others.

Financing Helps Businesses Grow by Focusing on Customers

When a customer wants to buy a generator, transfer switch, or any other type of backup power source that your business offers, he or she is there with the intent to purchase the goods and services that you provide.

However, intent does not always mean action. In fact, the more expensive the item, the less likely the customer will be to buy it on the spot. For many, the “just browsing” phase comes first as they get an idea of the cost for providing backup power to their home or office and explore whether or not the item fits in their budget. In most instances, it does not and they decide to move on.

Whether they return to your business to complete the sale is a 50/50 shot – at best. They may ultimately find a lower price or purchase a model of generator or battery that fits better within their budget in a month or two, maybe even longer.

If they do decide to return to your business, you may have waited two, four, six months before completing the sale and that’s a long time to sit around without generating the revenue on that purchase.

How Long Can Your Business Afford to Wait?

Sure, that’s only one customer – but imagine if that scenario plays out with a quarter of your customers or a third. What if that were happening with half of the customers who walk into your business. It’s more than likely your business won’t be around in six months if you’re waiting that long to generate enough revenue to merely keep the utilities bill paid much less grow the business.

But with financing programs through Fund My Contract, you can cater to your customers by giving them a choice of paying for the item or items they need without paying for it all up front at the time of purchase. Your business can offer financing programs that feature low monthly payments, flexible terms, or promotional rates that are available for a limited time only.

When a customer is aware that your business offers these options for payment, many of the barriers to completing a sale become less difficult to navigate. Simply because that high ticket item is now more affordable to fit into a monthly budget with installments that don’t increase, so it makes planning for the purchase easier and more predictable over time.

Why Financing Works for Your Generator Business

Fund My Contract is the market leader in consumer financing strategies for small businesses that offer backup power solutions to homes and offices. Smart, innovative financing options through our network of third-party lenders can recharge your business and get it on the right track towards success.

Increase Sales Faster, Sell More Products

When your customers know they can get the goods and services they need without having to pay in full at the time of purchase, they are typically more willing to convert the sale without “just browsing”. They know what they want, you have shown them the models and services that you offer and the prices are fair.

That increases the potential for closing the sale in a much shorter period of time. Even more advantageous for your business, when a customer knows that he or she won’t be expected to pay in one lump sum, the potential for higher ticket sales also increases. A customer who considered buying the entry level or base model of a generator may decide to go with the deluxe version with all of the best features.

Maintain Your Profit Margins

Companies that are struggling to survive will look for any way to keep the doors open. The first option typically includes charging less for products and services. A desperate business will try to attract customers with lower prices than the other guys in the area. But this strategy often hurts more than helps as those deep discounts only cut into otherwise already thin profit margins and hurting the bottom line for the purpose of attracting customers isn’t a long-term plan for success.

But with financing options through Fund My Contract, dropping prices to unsustainable levels to attract business is unnecessary. Instead, you can maintain your profits by offering customers an affordable option for buying generators and batteries at a fair price that will keep allow your business to grow instead of wither.

No More Waiting for Payment

Unpaid invoices and chasing after monies owed are a thing of the past. When a customer decides to participate in one of the financing programs you offer, once the financing arrangment is funded, that money goes directly to your business to pay the bill in full. The customer is now working directly with the lending partner to make the monthly payments on the financing that was given.

Under the arrangement, the customer pays the installments on time. If that doesn’t happen for whatever reason, your business still keeps the money that was paid.

After all, you made a sale or provided a service in good faith and once you are paid, you have no further responsibilities in the financing arrangement.

Increase Customer Satisfaction

When the customer gets the item he or she needs at a fair price and can pay for it over low, affordable installments that stay the same from month to month, that is a customer for life. They will come to rely on your business knowing they can count on you to supply them with the goods and services they need with financing programs that work within their budget.

The result is a happy customer who tells his or her friends and family and they become loyal customers as well. Before you know it, your customer base has grown with glowing reviews online and recommendations for your business on social media platforms.

Fund My Contract: Transforming Financing for Your Business

If your business could use some help generating revenue and finding more customers, consider giving Fund My Contract a call and speak with one of our financing experts to discuss how these programs can help you grow your business and thrive in a competitive marketplace.

Are you ready to change the course of your business and reach those sales projections faster? Get started today.

Growing Your Dental Practice in a Competitive Marketplace

Any business owner must understand the most effective methods for success. It’s no different for dental practitioners who are seeking out new ways to build a practice and achieve sustained growth.

admin

- April 18, 2023

3 Important Aspects of Offering Financing for Consumers

Many businesses are evolving and offering their customers Point Of Sale (POS) financing for their purchases. This is advantageous to customers and lets them purchase items they otherwise couldn’t afford by making payments.

admin

- May 8, 2023

Long Term Financing in Dental Offices

Let’s face it, dental work can be extremely expensive. When it comes to dental care most patients wait until something hurts before they make an appointment. They are willing to put off even preventive care

admin

- May 8, 2023